Have you inherited Greek real estate property, and you are wondering what the related legislation is?

Every country has its own inheritance regulations and according to taxation. The process of accepting inheritance when it comes from abroad may sound like a complex issue. To this purpose, we answer here some of the frequently asked questions.

How is Real Estate Property From Abroad Inherited?

As a general rule, inheritance relations are governed by the law of the nationality/citizenship of the deceased at the time of death.

The first defining factor in the inheritance procedure is the existence of a will. In the case the deceased testator had drafted a will, the relevant applicable law may be defined in that will. Generally and in most cases, the testator chooses the law of their own nationality/citizenship.

In plain words, a Dutch will governing Greek real estate property and drawn up by a Dutch citizen is valid in Greece. The acceptance of the inheritance by the heirs needs to be handled by a Greek notary, but who is inheriting what will be determined by Dutch law.

What Happens if There is No Will?

In the absence of a will, according to European Union Regulation nr. 650/2012, the law applicable to the inheritance shall be, in the vast majority of cases, the law of the State in which the deceased had their last habitual residence at the time of death.

For example, in the case of a Dutch woman married to a European man of any nationality and residing habitually in the Netherlands, Dutch law will be applicable.

If the same Dutch woman had her habitual residence in Greece, Greek law would be applicable. Interestingly, Greek law provides in article 28 of the Greek Civil Code that inheritance relations are governed by the law of the deceased’s nationality at the time of death. Which, in this case, will be again the Dutch Law.

In conclusion, in both cases, the applicable law is the Dutch inheritance law.

How is Greek Real Estate Property Inherited When the Heirs Live Abroad?

In Greece, real estate property has to be passed to the heirs by means of a notarial deed of inheritance acceptance. The heirs need to obtain a Greek tax number (“AFM”).

They also have to provide to the Greek notary a Death Certificate, as well as a Certificate of Inheritance Rights, mostly drawn up by a public notary in the State of the nationality of the deceased, bearing an Apostille stamp, in an official translation in Greek.

The notary then files an inheritance tax declaration, and the Taxation Office calculates the inheritance tax. In most cases, there is no or very little inheritance tax when real estate property is passed to close relatives. The property value on which the inheritance tax is calculated is not the (mostly much higher) commercial value but the lower “objective tax value” determined by the Greek Ministry of Finance.

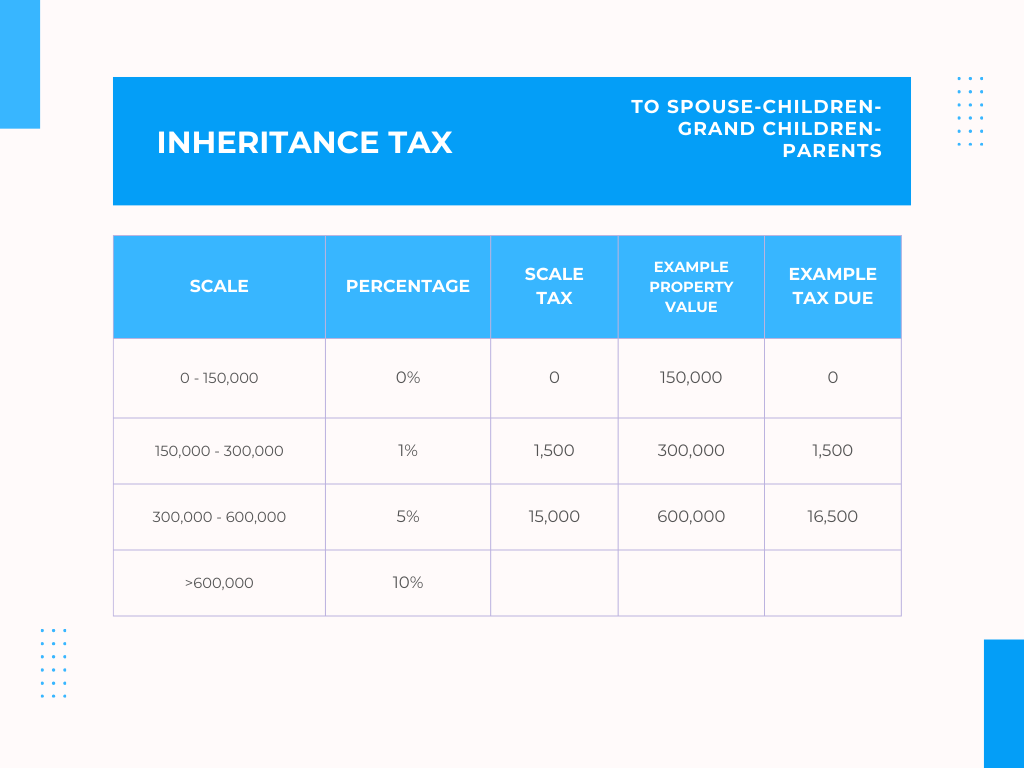

How Much is the Inheritance Tax in Greece?

There is a special inheritance tax exemption of 400.000 euros for the surviving spouse (after 5 years of marriage) and their minor children.

To save you time and peace of mind, the Elxis team of lawyers can handle all relevant legal matters, prepare the appropriate documentation and execution the whole procedure.

Do I Need to Be In Greece to Accept Inheritance?

No! One does not need to travel and be physically present in Greece to accept an inherited estate. It is necessary, however, that a Power of Attorney is signed, which would authorize the Elxis lawyers to represent the interests of the heir(s).

Is There Double Taxation on the Inherited Estate?

Many European countries have signed bilateral treaties in order to prevent conflicts in double taxation. This means that if the property in question is located abroad, you might be exempt from inheritance tax in your country of residence. Please consult a reliable tax consultant in your country of residence on this matter.

If you have any concerns about what a second house in Greece would mean for your descendants, don’t hesitate to contact our expert team of lawyers. With Elxis, the investment you make now will please all future generations too!